The Federal Minimum Wage in 2020

Last week, the nation found out that Florida approved a plan to raise the state minimum wage to $15/hour by 2026.

This has given momentum to other states and advocates of the measure, in hopes that the minimum wage will continue to be pushed up in other states as part of an effort since 2019 and the enactment of the “Raise the Minimum Wage Act” to bring the federal wage to $15/hour and supply low-wage workers with a livable wage for financial and economic stability.

Despite the act’s numerous benefits to many low-wage workers, there are going to be some consequences of the measure that will affect small businesses and how they operate.

However, despite the consequences that come from the Federal Minimum Wage in 2020, there are many innovative solutions businesses can use to stay economically afloat and healthy.

Let’s first start by stating some of the consequences for individuals and small businesses:

Consequences of Federal Minimum Wage in 2020

Small Businesses Are Affected

Raising the minimum wage to $15/hour will negatively affect small businesses in many different ways. One of the major consequences they will face is increased expenses that will affect their own operations and the people working for them as well.

It’s a simple fact. Many small to medium-sized businesses will be forced to reduce the number of employees on their payroll, because they won’t be able to afford increased cash outflow, from having to pay their employees substantially more money from the increased wage.

Especially because of COVID and nationwide lockdowns, small businesses have been impacted financially already. Even before COVID, small business were struggling and fearful of the minimum wage change. For example, small business owner of an outdoor equipment and clothing company, Tina Miller, says that when the $15 minimum wage hits her city in a couple of years, she genuinely doesn’t know how she will accommodate.

COVID alone has already reduced her revenue by 90% and they have barely been able to stay in business. If they survive COVID, the new wage will come as a new obstacle for financial stability.

According to research, in areas where the $15 minimum wage has been put into effect, employment rates have dropped, way fewer new businesses have opened, and more are shutting down.

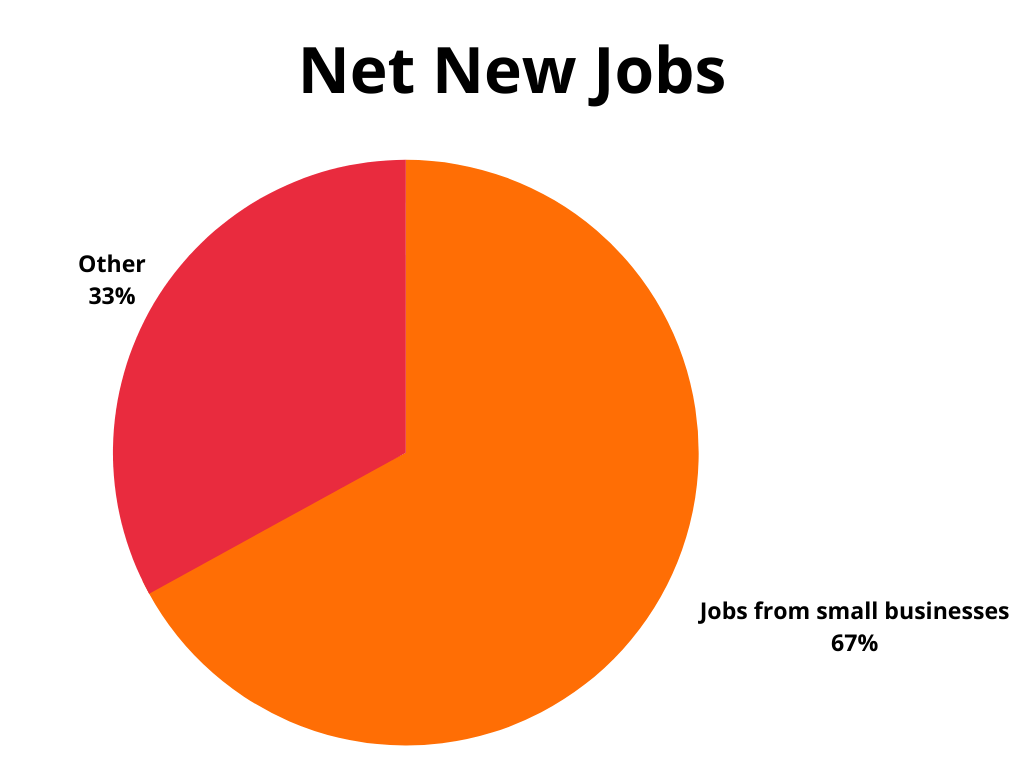

This is really unfortunate because small businesses are responsible for creating 2/3 of net new jobs and they drive U.S. innovation and competitiveness. They account for 44% of the U.S. economic activity.

From battling economic recessions to battling COVID lockdowns, and now dealing with the renewed reality of wage increases, businesses will be forced to adapt, or shut down. Additionally, it will leave some individuals in an economically disadvantaged position.

Individuals Are Affected Too

Many individuals will be affected as well. Although recent studies have shown that roughly 30 million people will gratefully benefit from this new wage increase, the same study also shows that millions more will also be disproportionately affected.

Many types of people described above will be affected, like part-time or full-time small business employees, because their employer can’t afford to keep them.

Other groups of people such as part-time workers (like teenagers or college students), low-skilled workers, or workers with just a high school diploma, and other groups will be negatively impacted financially—being less likely to secure jobs and financial stability.

What Will Be the Response to the Federal Minimum Wage in 2020?

Although many low-wage workers will gain greater financial stability and security (which is great), small, medium, and even large-sized businesses will be forced to question how to efficiently continue bringing on more labor for their business growth and stability.

The outcome of many entrepreneurs, small business owners, and mid-to-large-sized companies that want to see less profit go to payroll may look elsewhere for cheaper employment rates.

Whether they are going to other parts of the United States (temporarily) or other parts of the world (now and after 2026), U.S. businesses will begin to look and go elsewhere to fill employment needs so that they can sustain financial efficiency in their business.

The Solution

What will be businesses’ solutions to the problem of a really high minimum wage? There are many different avenues businesses can take, including increasing the speed and efficiency of their workforce, decreasing the size of their workforce, substantially raising prices, shutting down, or other forms of adaptability.

However, we predict that one of the most effective and beneficial solutions businesses can employ now and when the federal minimum wage locks in at $15, is hiring virtual assistants. When you hire virtual assistants, they are seen as huge assets for the following reasons:

Virtual Assistants Create a Leaner, More Efficient Workforce

By hiring virtual assistants, businesses can leverage part of their workforce utilizing the skillsets and excellent work ethics of virtual assistants, who work remotely from wherever they reside.

The method businesses can use to acquire this new lean workforce, is to designate in-house staff to high caliber or essential work. Then, designate much of the grunt work or repetitive tasks to a virtual assistant, where you can develop responsibilities for them to take ownership of.

50% of your workforce could be in-house, and the other 50% could be virtual. Tasks that can be done remotely would be completed by virtual assistants. This would leave your higher-wage in-house employees to complete more valuable work or work that has to be done in person.

For example, if you are a small business owner of a single retail shop in the downtown of your city, then use your in-house staff to open the store, work the sales floor during open hours, close the store, and complete other activities like hosting events or completing inventory.

Then, use your virtual assistant to complete other tasks, like operating the company telephone and email inbox to handle customer inquiries, concerns, and other customer services requests.

Use your virtual assistant to manage most of the marketing for your business, including email marketing, social media marketing, event coordination and preparation, and content creation. They can even coordinate online events and manage eCommerce.

Here at Virtudesk, we train our virtual assistants in marketing, customer service, business administration, human resources, and more.

Especially with the COVID lockdowns this year, it has shown us that most of our work, if not all of it can be done remotely! This has given the U.S. (and world) workforce a greater understanding of all the work virtual assistants can do too.

Not only can virtual assistants create a leaner workforce for your business, but they cost significantly less.

Virtual Assistants Cost Less Than a Minimum Wage Worker

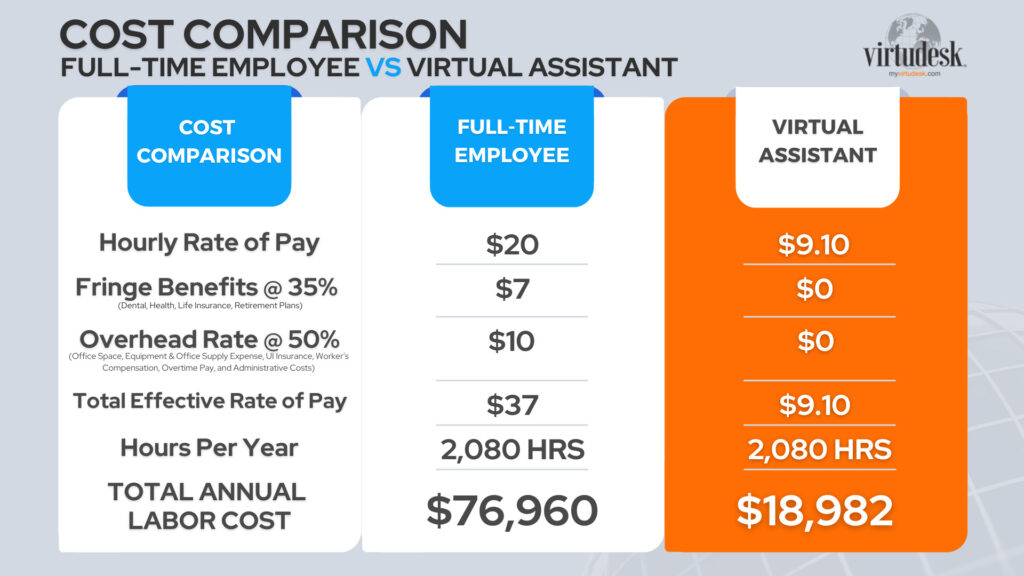

Not only would you have to pay $15/hour for a minimum wage worker, but you would have to pay payroll taxes, fringe benefits, and overhead from keeping them in an office or working space.

For every year you hire just one full-time virtual assistant, you can save as much as $60,000.

With virtual assistants, the company you source from covers the pay and benefits, so you only have to pay a consistently low rate every time.

At Virtudesk, our rates start as low as $8.60/hour. All you pay is the $8.60 an hour rate plus a low sign-up fee, and the rest is left to us. You can choose from full-time, part-time, or time block virtual assistants. The reason why the cost of our virtual assistants is so low is that our virtual assistants are based in the Philippines.

The Philippines is the most popular and affordable location for outsourcing and hiring virtual assistants due to the low cost of living, accent-neutral English, exposure to Western culture, and amazing work ethics of the Filipinos.

Virtual Assistants Are Experienced and Career-Driven

Not only are virtual assistants much lower in total cost than hiring in-house staff, but they are also extremely career-driven, college-educated, and experienced individuals.

They are highly competent and skilled professionals that can truly perform on many different aspects of your business.

If you’re hiring someone in the U.S. for a $15 minimum wage, they will have little to no experience or skills compared to that of a virtual assistant, and a virtual assistant costs less!

At Virtudesk, we make sure that our virtual assistants are rigorously trained. Not only do we require our virtual assistants to have call center and corporate level experience, but we train them on our company-owned online academy, Virtudesk Academy, where they are trained to be proficient on many of the industry’s top CRMs, platforms, business best practices, and more.

We also use platforms like Timedly, to monitor progress. As a client, you can monitor what tasks your virtual assistant completes, and how much time it took to complete each task.

Overall, virtual assistants have the power to truly leverage and transform your business. Although a $15/hour minimum wage feels daunting, and you may be wondering how you will cover this future expense, know that there are ways to adapt comfortably.

Many businesses and entrepreneurs will choose to look elsewhere for lower labor costs, and choosing to hire a virtual assistant is just one way to achieve that goal.

More Articles From Virtudesk:

Share this article

Meet our Most Trusted

Partners & Clients

Byron Lazine

Co-Founding Chief-of-Operations at BAM (Broke Agent Media)I’ve been using Virtual Assistants for years throughout all of my companies. Once we found Virtudesk the process got even easier and allowed us to scale out our hiring. Highly skilled and accountable professionals. 100% recommend!

Rebecca Julianna James

Realtor / Content CreatorBefore getting started with Virtudesk I had my doubts that they would find what I was looking for. I needed a very particular person to add to my team and let me tell you I am highly pleased! My virtual assistant Myril is the best! I am excited to grow my socialmedia accounts with her. Thank you Virtudesk!

Chelsea Erickson

Realtor La Belle RE GroupI am very happy with the assistance Virtudesk is providing for my real estate business. This is a newer position for my company and we are working through the creation and efficiency.